Find Out How the SheSpeaks Team is Taking Financial Control #OwnMyFuture

Disclosure: This is a sponsored post for Prudential.

Through our work with Prudential, we’ve been learning about the unique financial challenges women face and why it’s so important for women to start talking about their finances so they can take control of their financial futures.

For example, did you know that women outlive men by an average of 5-6 years1? This time is often not accounted for in our retirement planning. Another startling statistic: The average woman working full-time earns 79% of the income earned by her male counterpart2, which also affects women’s 401K balances over their as well as their social security payments.

It’s so important to start a conversation about these issues, so we can jump into proactively owning our financial futures. We’re sharing some of our “aha” moments that have made us step up and start taking control of our finances.

Kelly: I’m getting married this year (yay!) and as amazing as this time of my life is, being engaged has forced me to put my finances under a microscope.

In my early twenties I made some irresponsible decisions when it came to money. I’ve known for a long time that my finances needed TLC, but I just didn't want to deal with it. I thought, "I can manage on my own! I have enough going on to deal with money!" Becoming a family means thinking for one isn't going to fly anymore.

My personal finances will affect not only me, but my fiancé too. I would never want any poor decision I made when I was 22 to affect him. That was my "aha" moment, I knew I needed to get things under control and own my future, for me and for us together. My future will be our future soon, and I want to set us both up for success. I’ve already started to take steps to improve, and it’s exciting to think about what the future will hold!

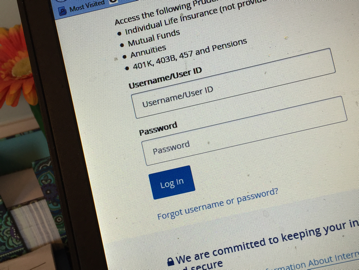

Susan: A couple of years ago, my brother-in-law died suddenly. My sister not only had to deal with the emotional pain of his passing, but she now also had to take care of their finances all on her own. Seeing her go through it all really showed me how much I needed to learn. It was small things, like figuring out the passwords he used so she could access accounts. And the big things, like budgeting the money she got from his life insurance. It motivated me to make sure I knew everything about my family’s financial situation, and to plan for the worst, while hoping it will never happen.

Emily: I’m a planner by nature, so when my husband and I started talking about having a baby, one of the first things on my to-do list was to go through our finances. It was important to me to get a good overall look at our spending habits and determine how much we’d need to save to be comfortable for upcoming expenses, taking time off work, and ultimately starting a college fund. We kept hearing from family and friends that babies are expensive – but it took some research on our part to figure out just how expensive our little one might be, and how we could set ourselves up the best for our future without sidelining other financial goals, like saving for a house and paying into our retirement accounts.

Aliza: From the time my girls were born, we were saving for college – but now this financial goal is coming up around the corner! As we’re just a few years away from college, it’s the perfect time for me to check in on our financial plans. Their financial future is too important to ignore!

Are you ready to own your future? Click here to learn more from Prudential and connect with a Prudential advisor today.

Comment on our post and share the “aha” moment that has made you want to take control of your financial future!

Sources.

1.Prudential Retirement analysis; National Center for Health Statistics, Health, United States, 2015: With Special Feature on Racial and Ethnic Health Disparities. Hyattsville, MD. 2016

2. U.S. Census Bureau, Historical Income Tables Table P-40: Women’s Earnings as a Percentage of Men’s Earnings by Race and Hispanic Origin, 2016

_01252024061712.jpg?max-w=432&max-h=220&fit=crop&auto=format)

_10242023164832.jpg?max-w=432&max-h=220&fit=crop&auto=format)

_08172023152001.jpg?max-w=432&max-h=220&fit=crop&auto=format)

(6)_07082023175312.jpg?max-w=432&max-h=220&fit=crop&auto=format)

(1)_05192023144508.jpg?max-w=432&max-h=220&fit=crop&auto=format)

(37)_05032023114523.jpg?max-w=432&max-h=220&fit=crop&auto=format)

(3)_04112023125932.jpg?max-w=432&max-h=220&fit=crop&auto=format)

(36)_04272023152113.jpg?max-w=432&max-h=220&fit=crop&auto=format)